Business Insurance in and around Grants

Calling all small business owners of Grants!

No funny business here

Coverage With State Farm Can Help Your Small Business.

When you're a business owner, there's so much to focus on. We get it. State Farm agent Chris Winch is a business owner, too. Let Chris Winch help you make sure that your business is properly protected. You won't regret it!

Calling all small business owners of Grants!

No funny business here

Cover Your Business Assets

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your compensation, but also helps with regular payroll expenses. You can also include liability, which is key coverage protecting your company in the event of a claim or judgment against you by a customer.

When you get a policy through one of the leaders in small business insurance, your small business will thank you. Contact State Farm agent Chris Winch's team today with any questions you may have.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

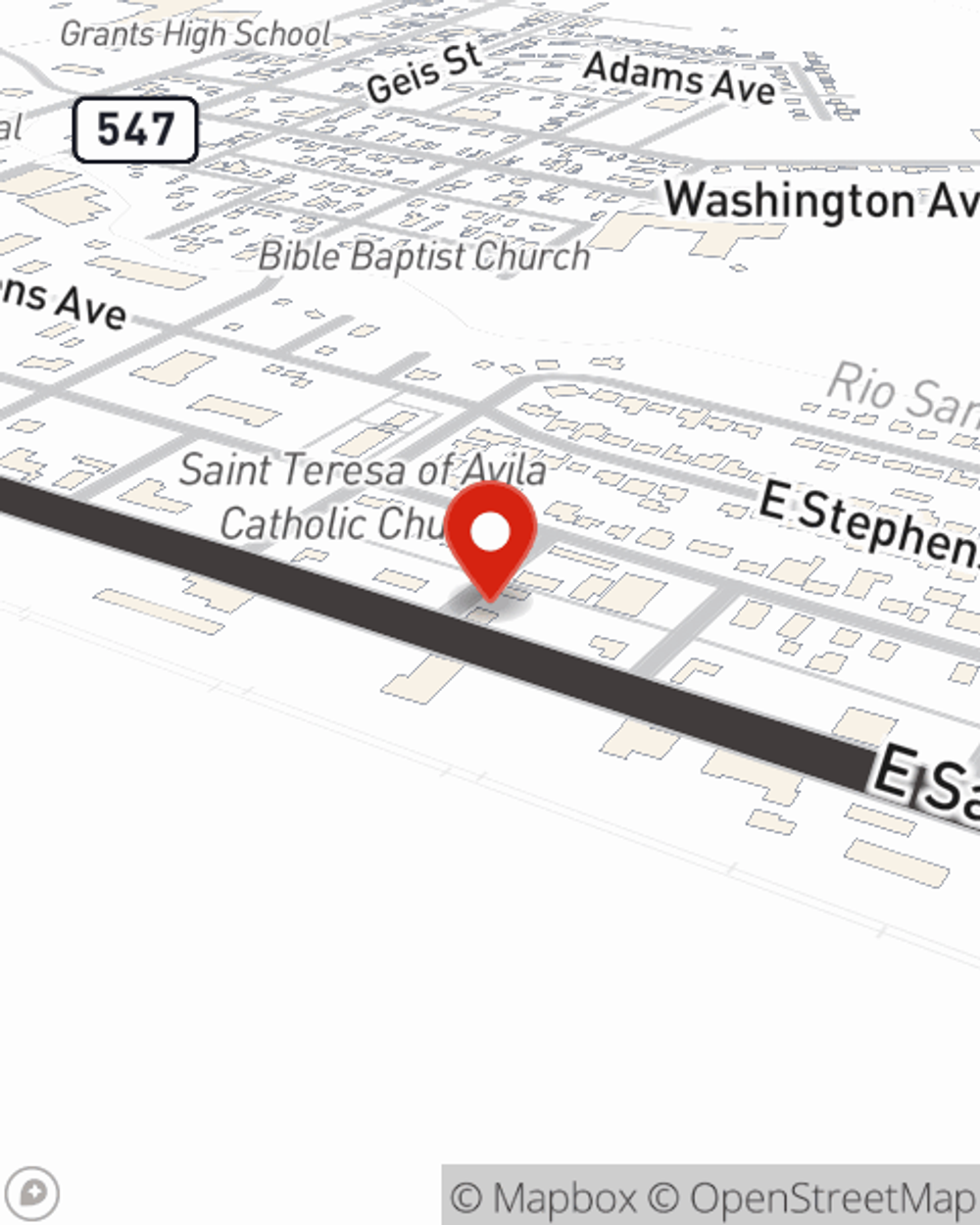

Chris Winch

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.